The oil cartel is still influential, and American shale can't replace the world's true "swing" producer.

The breathtaking crash in oil prices has generated a new conventional wisdom: America’s shale oil industry has supplanted OPEC as the so-called “swing” producer, rendering the 55-year-old cartel powerless to affect the price of crude. Veteran oil analyst Daniel Yergin told Bloomberg TV this week that the emergence of U.S. shale companies as “the swing producer” contributes to oil price volatility “because you’re talking about the impact of decisions made by thousands of individual producers.”

With apologies to Yergin and others saying similar things, this is wrong on several levels. OPEC remains the only group that can meaningfully affect the price of oil by purposely raising or lowering output. American shale producers don’t coordinate their actions strategically the way the Vienna-based organization does; they must take whatever price the market gives them. To the degree that American shale producers do influence world oil prices by independently raising output when prices are high and cutting it when prices are low, they tend to stabilize the market, not add to volatility, as Yergin contends. (A spokesman for Yergin said he was traveling and not available for comment on this story.)

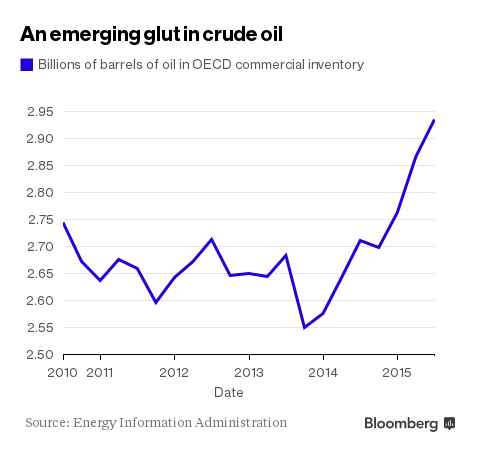

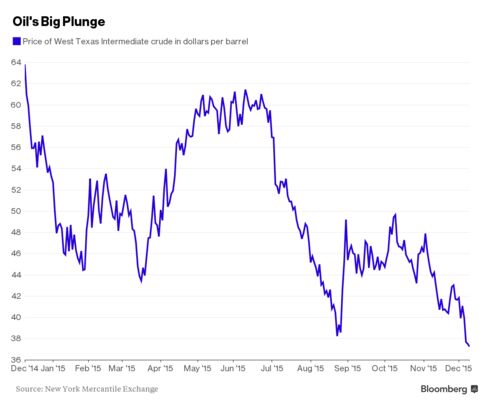

Oil is certainly volatile at the moment. The price of West Texas Intermediate, the U.S. benchmark, stood at slightly over $100 a barrel as recently as June 2014. But soft economic growth and rising production, including from American frackers, has pushed it steadily lower. It broke below $40 on Dec. 4, the day OPEC oil ministers meeting in Vienna announced that production levels would remain unchanged, and it continued to sag in the following days, reaching a six-year low of $37.23 on Dec. 9. Inventories in the Organization of Economic Cooperation and Development nations, up 11 percent since June 2014, are at the highest since at least 1996.

Notice that oil’s latest slide didn’t occur after a price-setting conclave of U.S. frackers in Houston—and that's because there is no such gathering. The drop came after a pivotal OPEC meeting in which the cartel’s most important member, Saudi Arabia, chose to maintain market share rather than to cut back production in hopes of pushing the price up for the good of the cartel as a whole. The point is: What OPEC does still matters.

There’s a reason that America’s shale industry is often described—by Goldman Sachs, the Economist, Bloomberg News, and others—as a “swing” producer. It is influential: By contributing to an oil glut, it has prevented OPEC from propping up prices in the triple digits. Also, its output, like OPEC’s, is closely watched by the market for clues to price trends.

But a true swing producer has freedom of action. It has a large market share, spare capacity, and very low production costs, and it is capable of acting strategically—alone or in a cartel—to raise and lower production to affect the price. Saudi Arabia fits that description; America’s shale producers don’t. The shale players are too small to move prices on their own, and they don’t act in concert. Shale producers have essentially no spare capacity because they’re always producing as much as they profitably can. Production costs are also far higher than those of the Saudis or Kuwaitis. In the language of economics, U.S. shale producers are price takers, not price setters.

“Saudi Arabia is still the swing producer,” said Amy Jaffe, executive director of energy and sustainability at the University of California-Davis. Shale producers, in contrast, are more opportunistic than strategic. They are getting bloodied now, and their output is likely to drop sharply in the next six months as old wells run dry and aren’t replaced with new ones. But they will spring back quickly if oil gets back to a range at which they can make money, said Jaffe: “If I’m a shale producer, you should think of me like the guy with the foldable lawn chair in a game of musical chairs. I’m never getting knocked out of the game.”

Frackers aren’t the ones starting and stopping the music. The imprecise use of swing producer as a “crutch phrase” to describe America’s shale industry has real-world consequences, said David Livingston, an associate in the energy and climate program of the Carnegie Endowment for International Peace. “People see this language and reflexibly accept it. They think that it means the U.S. can balance the oil market,” he said. “It leads people to think they can turn their backs on the role OPEC plays.”

Turning one’s back on OPEC now would not be wise. Gluts are poisonous to any cartel, whether oil or diamonds or cocaine. But if the balance shifts and the glut disappears, OPEC will once again be able to drive prices higher. By letting prices fall, the Saudis hope to kill off some higher-priced competition in the medium term, said Marc Chandler, head of currency strategy at Brown Brothers Harriman. In a Dec. 8 note to clients, Chandler wrote: “The action of a cartel trying to discipline the market and a collapsed cartel may look eerily similar from a high level of abstraction, but they are as different as a surgeon cutting a patient in a surgical procedure and a stabbing.”

No comments:

Post a Comment