Keystone rejected, Exxon investigated—this doesn’t end well for oil.

There were two huge developments today, both for the oil industry and the earth's climate. New York’s top lawyer issued a subpoena to Exxon, seeking information on whether the world’s biggest oil explorer deceived the public for almost 40 years about climate change. Hours later, President Obama announced that the U.S. would reject the Keystone pipeline.

The rejection of Keystone is more symbolic than substantive. The pipeline would have added $3.4 billion in economic growth but contributed to climate change by speeding up production of oil-sands crude, which is about 17 percent more carbon-intensive than the conventional barrel. Rejection will neither halt oil-sands production nor damage the broader economy. Perhaps anticipating rejection, TransCanada had asked to postpone the final review earlier this week.

The investigation of Exxon could have more far-reaching implications. Alleged disinformation by oil companies has long been compared to the actions of big tobacco, which eventually agreed to pay hundreds of billions of dollars in settlements. The New York probe follows investigative articles by Inside Climate News and the Los Angeles Times alleging that Exxon’s scientists had evidence that carbon dioxide emissions were damaging the environment as far back as 1977. At a minimum, the probe could put a chill on anti-climate change funding during a critical U.S. election year.

Both actions come as more than 80 world leaders prepare to meet in Paris this month to hammer out final details on the most ambitious global pact yet to curb the future course of climate change. The biggest current and future polluters—including the U.S., China, and India—have already made aggressive long-term pledges ahead of the meeting.

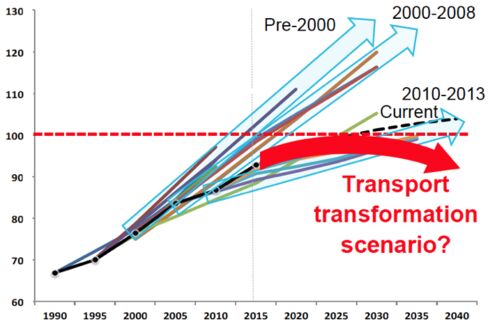

The world will depend on oil for decades to come. But 2015 may very well be remembered as the beginning of the end, with the rejection of Keystone and the investigation of Exxon as key markers on the timeline. Here’s a chart of oil forecasts from the International Energy Agency since 1994, from a Bloomberg New Energy Finance keynote presentation this week in Shanghai. Forecasts have been dropping, and the transformation of oil markets may be coming sooner than we think.

Declining Prospects for Oil

No comments:

Post a Comment